Do You Charge Sales Tax On Design Services . Some states charge sales tax on all services by default, while others differentiate. Check with your jurisdiction to verify your rate. Some states charge a different rate for services sales tax than they do for retail sales. Yet some states still haven’t clearly defined how sales and use tax applies to digital goods and services. If your design fee is based on a markup of goods, it will be included as subject to sales tax. If you sell service contracts separately or in tandem with sales of tangible goods, you may be liable to collect sales tax. If your services are directly. Anyone who sells interior decorating. This bulletin explains how sales and use taxes apply to interior decorating and design services. Determine if your consulting fees are taxable:

from www.vrogue.co

Some states charge a different rate for services sales tax than they do for retail sales. If you sell service contracts separately or in tandem with sales of tangible goods, you may be liable to collect sales tax. Determine if your consulting fees are taxable: Check with your jurisdiction to verify your rate. Yet some states still haven’t clearly defined how sales and use tax applies to digital goods and services. If your services are directly. Anyone who sells interior decorating. This bulletin explains how sales and use taxes apply to interior decorating and design services. Some states charge sales tax on all services by default, while others differentiate. If your design fee is based on a markup of goods, it will be included as subject to sales tax.

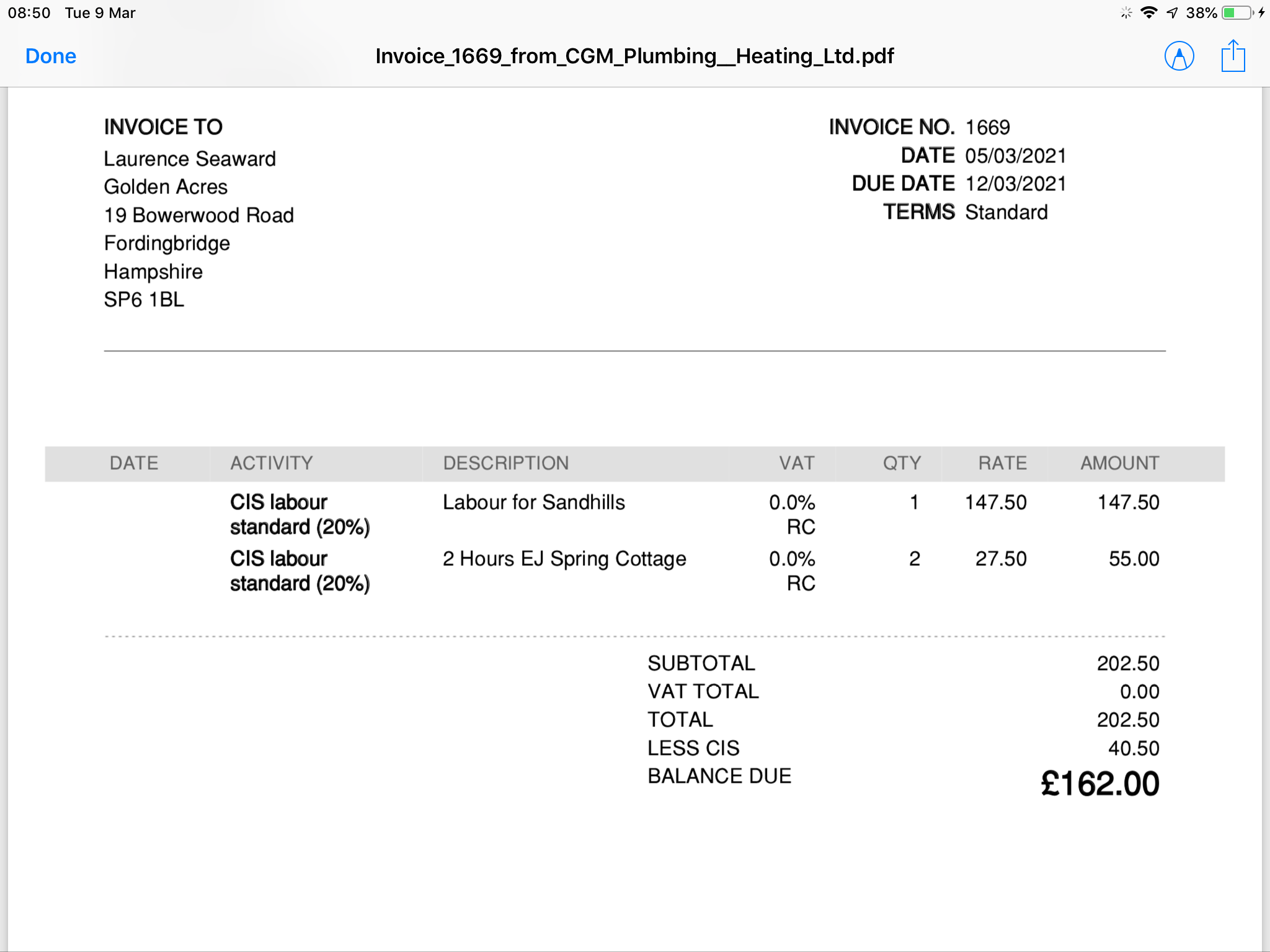

Cis Vat Invoice Template Cards Design Templates vrogue.co

Do You Charge Sales Tax On Design Services Anyone who sells interior decorating. Some states charge a different rate for services sales tax than they do for retail sales. If your design fee is based on a markup of goods, it will be included as subject to sales tax. Determine if your consulting fees are taxable: Check with your jurisdiction to verify your rate. Yet some states still haven’t clearly defined how sales and use tax applies to digital goods and services. Anyone who sells interior decorating. Some states charge sales tax on all services by default, while others differentiate. If your services are directly. If you sell service contracts separately or in tandem with sales of tangible goods, you may be liable to collect sales tax. This bulletin explains how sales and use taxes apply to interior decorating and design services.

From www.examples.com

Sales Invoice 17+ Examples, Word, Excel, PDF Do You Charge Sales Tax On Design Services This bulletin explains how sales and use taxes apply to interior decorating and design services. Some states charge sales tax on all services by default, while others differentiate. If your services are directly. Anyone who sells interior decorating. Check with your jurisdiction to verify your rate. Some states charge a different rate for services sales tax than they do for. Do You Charge Sales Tax On Design Services.

From okcredit.com

Should States Charge Sales Tax To Online Business? Do You Charge Sales Tax On Design Services Determine if your consulting fees are taxable: Yet some states still haven’t clearly defined how sales and use tax applies to digital goods and services. If your design fee is based on a markup of goods, it will be included as subject to sales tax. This bulletin explains how sales and use taxes apply to interior decorating and design services.. Do You Charge Sales Tax On Design Services.

From help.invoicing-software.com

UK HMRC VAT Reverse Charge Support SliQ Invoicing Online Help Do You Charge Sales Tax On Design Services If your services are directly. Anyone who sells interior decorating. Some states charge a different rate for services sales tax than they do for retail sales. If your design fee is based on a markup of goods, it will be included as subject to sales tax. This bulletin explains how sales and use taxes apply to interior decorating and design. Do You Charge Sales Tax On Design Services.

From ecommercebadassery.com

How to Charge Sales Tax for Your Business Badassery Do You Charge Sales Tax On Design Services If your services are directly. If your design fee is based on a markup of goods, it will be included as subject to sales tax. Yet some states still haven’t clearly defined how sales and use tax applies to digital goods and services. If you sell service contracts separately or in tandem with sales of tangible goods, you may be. Do You Charge Sales Tax On Design Services.

From okcredit.com

Should States Charge Sales Tax To Online Business? Do You Charge Sales Tax On Design Services Determine if your consulting fees are taxable: Yet some states still haven’t clearly defined how sales and use tax applies to digital goods and services. Anyone who sells interior decorating. Check with your jurisdiction to verify your rate. This bulletin explains how sales and use taxes apply to interior decorating and design services. Some states charge a different rate for. Do You Charge Sales Tax On Design Services.

From www.tallyknowledge.com

How to Create Reverse Charge GST Invoice in TallyERP.9 Do You Charge Sales Tax On Design Services Determine if your consulting fees are taxable: Some states charge a different rate for services sales tax than they do for retail sales. Anyone who sells interior decorating. If your services are directly. Some states charge sales tax on all services by default, while others differentiate. If you sell service contracts separately or in tandem with sales of tangible goods,. Do You Charge Sales Tax On Design Services.

From help.tallysolutions.com

GST Reverse Charge Outward Supply of Services Do You Charge Sales Tax On Design Services Some states charge sales tax on all services by default, while others differentiate. Determine if your consulting fees are taxable: Some states charge a different rate for services sales tax than they do for retail sales. If your design fee is based on a markup of goods, it will be included as subject to sales tax. If you sell service. Do You Charge Sales Tax On Design Services.

From www.vrogue.co

Cis Vat Invoice Template Cards Design Templates vrogue.co Do You Charge Sales Tax On Design Services If your services are directly. If your design fee is based on a markup of goods, it will be included as subject to sales tax. If you sell service contracts separately or in tandem with sales of tangible goods, you may be liable to collect sales tax. Some states charge a different rate for services sales tax than they do. Do You Charge Sales Tax On Design Services.

From www.taxjar.com

Sales Tax by State Should You Charge Sales Tax on Digital Products Do You Charge Sales Tax On Design Services If your services are directly. If you sell service contracts separately or in tandem with sales of tangible goods, you may be liable to collect sales tax. Anyone who sells interior decorating. Some states charge sales tax on all services by default, while others differentiate. Yet some states still haven’t clearly defined how sales and use tax applies to digital. Do You Charge Sales Tax On Design Services.

From www.shopify.com

How To Charge Sales Tax in the US A Simple Guide for 2023 Shopify UK Do You Charge Sales Tax On Design Services This bulletin explains how sales and use taxes apply to interior decorating and design services. Some states charge sales tax on all services by default, while others differentiate. Anyone who sells interior decorating. Yet some states still haven’t clearly defined how sales and use tax applies to digital goods and services. Check with your jurisdiction to verify your rate. Some. Do You Charge Sales Tax On Design Services.

From meetanshi.com

How To Charge Sales Tax On Shopify Do You Charge Sales Tax On Design Services Anyone who sells interior decorating. This bulletin explains how sales and use taxes apply to interior decorating and design services. Check with your jurisdiction to verify your rate. If your design fee is based on a markup of goods, it will be included as subject to sales tax. Determine if your consulting fees are taxable: Some states charge a different. Do You Charge Sales Tax On Design Services.

From www.eventbrite.com

How to charge U.S. sales tax on ticket sales Eventbrite Help Center Do You Charge Sales Tax On Design Services If you sell service contracts separately or in tandem with sales of tangible goods, you may be liable to collect sales tax. Some states charge sales tax on all services by default, while others differentiate. Determine if your consulting fees are taxable: Anyone who sells interior decorating. If your design fee is based on a markup of goods, it will. Do You Charge Sales Tax On Design Services.

From www.youtube.com

Do I Need to Charge Sales Tax? YouTube Do You Charge Sales Tax On Design Services If your services are directly. Anyone who sells interior decorating. If you sell service contracts separately or in tandem with sales of tangible goods, you may be liable to collect sales tax. Some states charge a different rate for services sales tax than they do for retail sales. Determine if your consulting fees are taxable: Yet some states still haven’t. Do You Charge Sales Tax On Design Services.

From www.pinterest.com

Sales Tax by State Should You Charge Sales Tax on Digital Products Do You Charge Sales Tax On Design Services Anyone who sells interior decorating. Some states charge a different rate for services sales tax than they do for retail sales. If you sell service contracts separately or in tandem with sales of tangible goods, you may be liable to collect sales tax. Determine if your consulting fees are taxable: If your services are directly. Yet some states still haven’t. Do You Charge Sales Tax On Design Services.

From taxlawresearch.com

Get The Answers You Need Do I Charge Sales Tax on Services? Tax and Do You Charge Sales Tax On Design Services If your services are directly. Anyone who sells interior decorating. Some states charge a different rate for services sales tax than they do for retail sales. If your design fee is based on a markup of goods, it will be included as subject to sales tax. If you sell service contracts separately or in tandem with sales of tangible goods,. Do You Charge Sales Tax On Design Services.

From www.anrok.com

Should you charge sales tax to international customers? Anrok Do You Charge Sales Tax On Design Services If your design fee is based on a markup of goods, it will be included as subject to sales tax. This bulletin explains how sales and use taxes apply to interior decorating and design services. Check with your jurisdiction to verify your rate. Some states charge a different rate for services sales tax than they do for retail sales. Anyone. Do You Charge Sales Tax On Design Services.

From logistis.design

When to Charge Sales Tax on Shipping According to the CDTFA Logistis Do You Charge Sales Tax On Design Services Determine if your consulting fees are taxable: This bulletin explains how sales and use taxes apply to interior decorating and design services. Some states charge a different rate for services sales tax than they do for retail sales. Check with your jurisdiction to verify your rate. Anyone who sells interior decorating. Yet some states still haven’t clearly defined how sales. Do You Charge Sales Tax On Design Services.

From www.quaderno.io

The Ultimate Guide to EU VAT for Digital Taxes Do You Charge Sales Tax On Design Services If you sell service contracts separately or in tandem with sales of tangible goods, you may be liable to collect sales tax. Check with your jurisdiction to verify your rate. Yet some states still haven’t clearly defined how sales and use tax applies to digital goods and services. Anyone who sells interior decorating. If your design fee is based on. Do You Charge Sales Tax On Design Services.